owners draw report in quickbooks online

Go to Chart of Accounts. Choose Lists Chart of Accounts or press CTRL A on your keyboard.

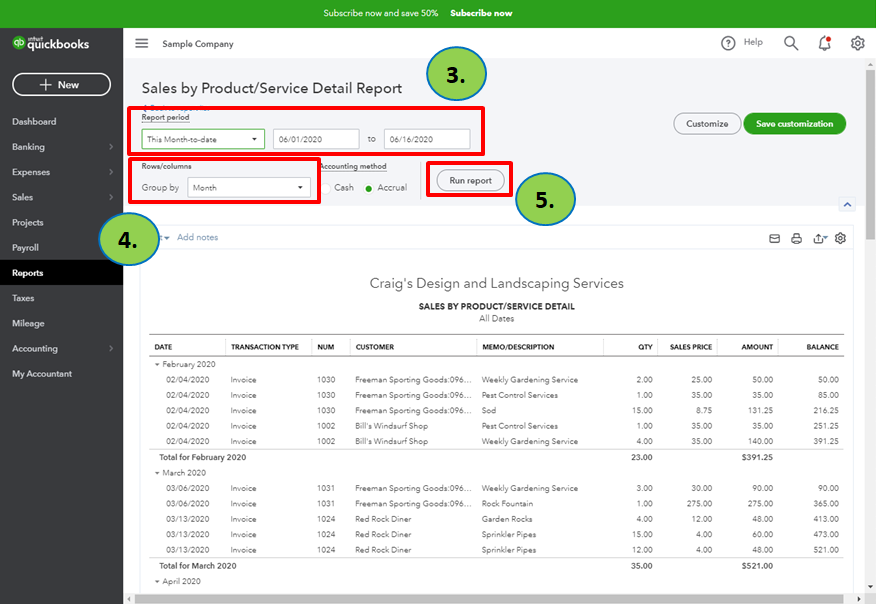

How Do I Run A Month To Month Sales Revenues Comparison For 2018

For a company taxed as a sole proprietor or partnership I recommend you have the following for ownerpartner equity accounts one set for each partner if a partnership October 15 2018 05.

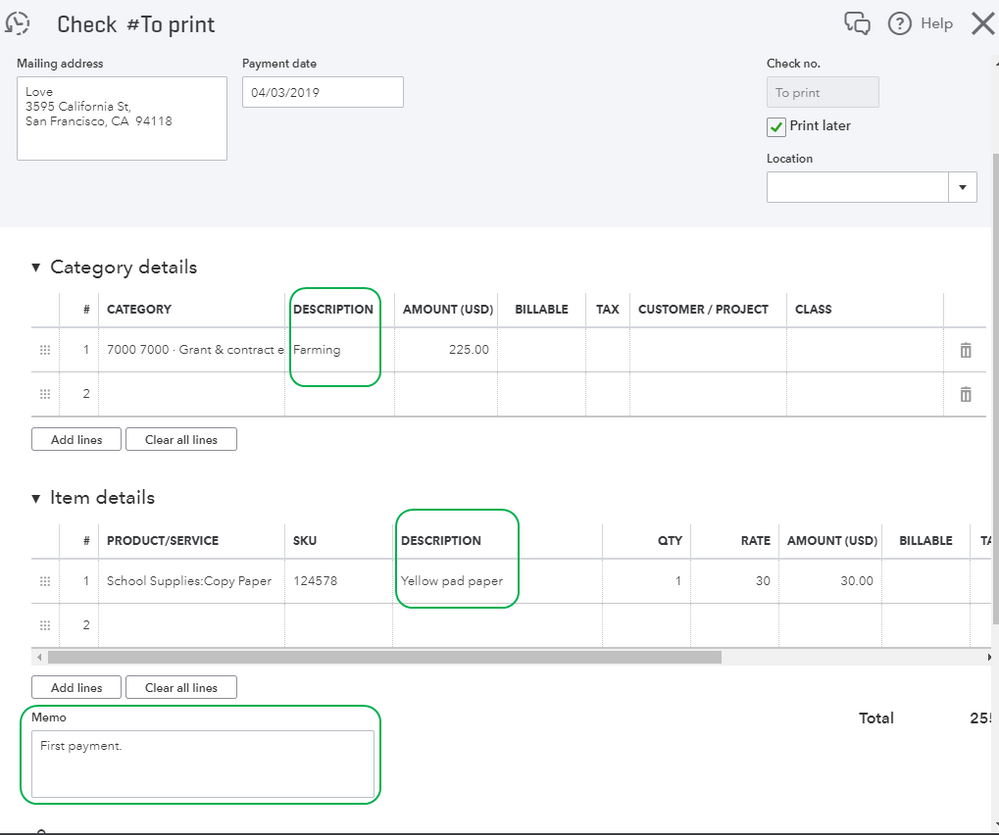

. Click on the Banking menu option. To Write A Check From An Owners Draw Account the steps are as follows. 1 Create each owner or partner as a VendorSupplier.

You can follow this article for step by step procedure to enter the owners draw in QuickBooks. Heres how to do it. Select Equity from the Account Type drop-down.

QuickBooks Online In years past the business had a contractor who the owner married and for tax year 2021 they are business partners. Make sure you use owners contributionsdraws equity vs. Set up and pay a draw for the owner.

Via Chart of Accounts. Set up draw accounts. Then choose the option Write Checks.

Write Checks from the Owners Draw Account. Expenses VendorsSuppliers Choose New. Open the chart of accounts use run report on that account from the drop down arrow far right of the account name.

Click Chart of Accounts and click Add. Only a sole proprietorship a partnership a disregarded entity LLC and a partnership LLC can have owner draws. How do I show owner pay in QuickBooks.

Setting up Owners Draw in QuickBooks Online. At the bottom left choose Account New. Enter the account name and description Owners Draw is recommended When you are done hit on Save Close button.

Find the account go it its Action column and click View register. Corporations should be using a liability account and not equity. How do I report an owners draw in QuickBooks.

To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks. Select the Equity account option. There are two methods to Record an Owners Draw in QuickBooks.

Locate your opening balance entry then choose it. Click Equity Continue. Enter and save the information.

October 15 2018 0559 PM. It is also helpful to maintain current and prior year draw accounts for tax purposes. Select Save and Close.

Select New in the Chart of Accounts window. Select the Bank Account Cash Account or Credit Card you used to make the purchase. Search for the owners pay.

Enter Owner Draws as the account name and click OK. 2 Create an equity account and categorize as Owners Draw. Go to Banking Write Checks.

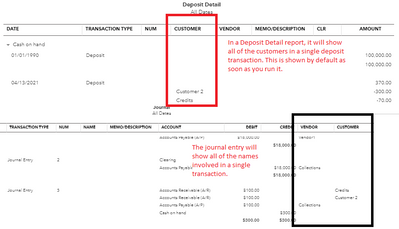

This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Enter an opening balance. Recording draws in Quickbooks requires setting up owner draw accounts and posting monies taken out of the business bank account for personal reasons to the draw accounts.

How to Record Owner Draws Into QuickBooks Click the List option on the menu bar at the top of the window. Select Owners Equity from the Detail Type drop-down. In QuickBooks Desktop software.

Enter the Amount. To create an owners draw account. Click the Expenses tab and then select the account category that best fits your needs.

Select Chart of Account under Settings. From the PAY TO THE ORDER OF field select the vendors name. Due tofrom owner long term liability correctly.

If youre unable to edit the amount on this screen in some cases. If youre the business owner and want to record an owners draw youll basically want to write the check out to yourself like you are paying yourself with a check. Click Save Close.

Select the Gear icon at the top then Chart of Accounts. Enter the account name Owners Draw is recommended and description. Use your Gear icon.

Category Type Equity. Would you simply categorize payments to this person as Owners Draw.

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

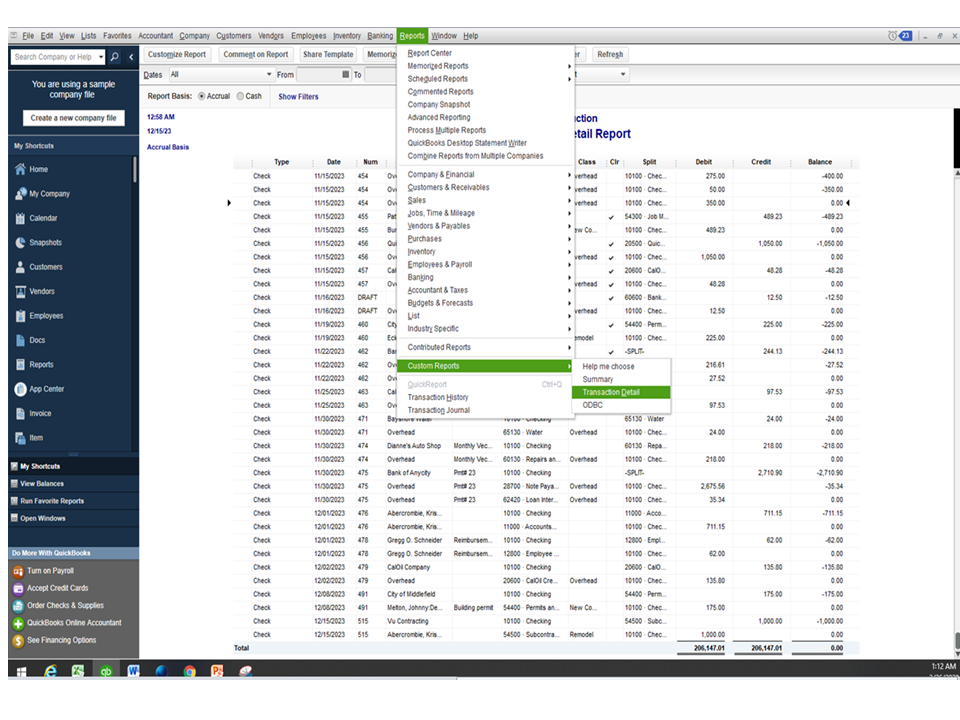

Solved Transaction Detail By Account Report

Monthly Status Report Template 7 Templates Example Templates Example Progress Report Template Report Template Executive Summary Template

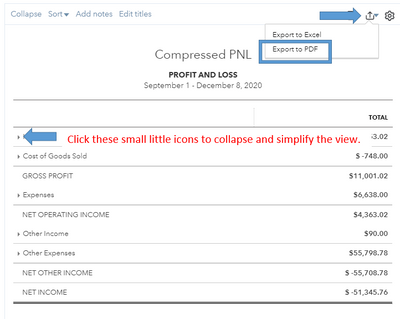

Solved Custom Profit And Loss Report

Double Entry Accounting Has Come To Freshbooks Small Business Accounting Accounting Double Entry

Solved How Do I Create A Custom Report For A Specific Account

Save Custom Reports In Quickbooks Online Instructions Quickbooks Online Quickbooks Best Templates

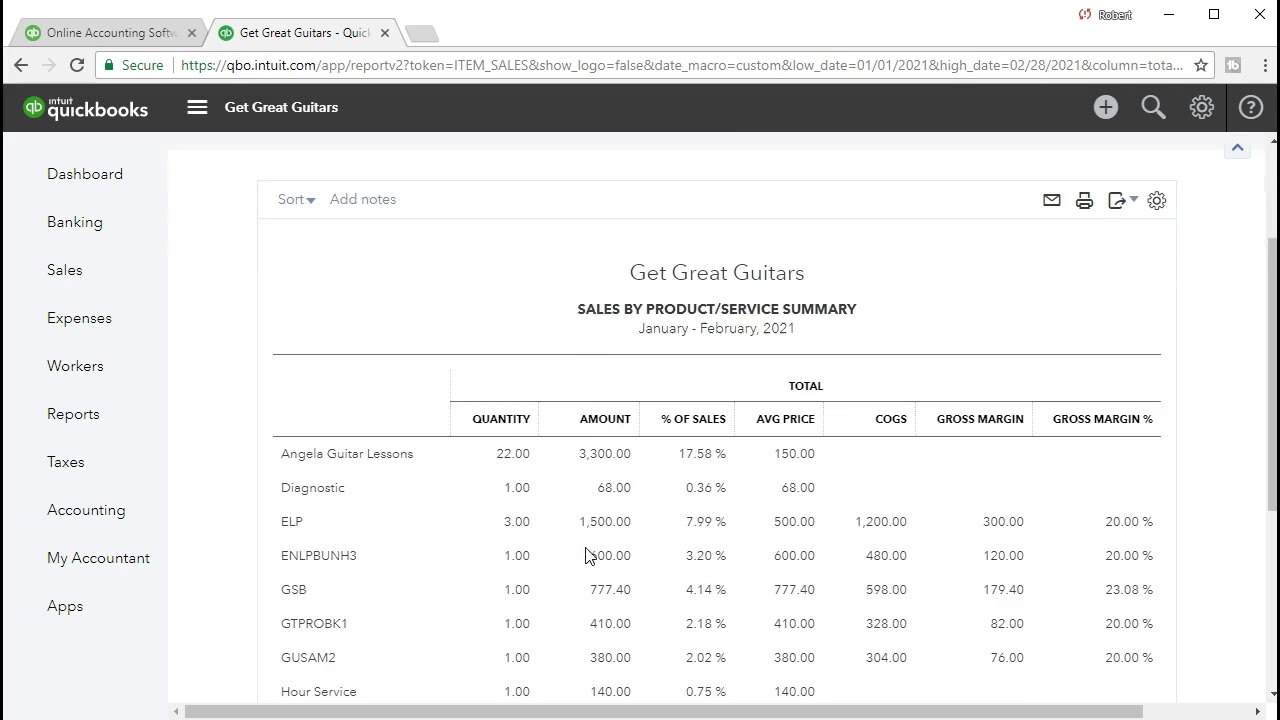

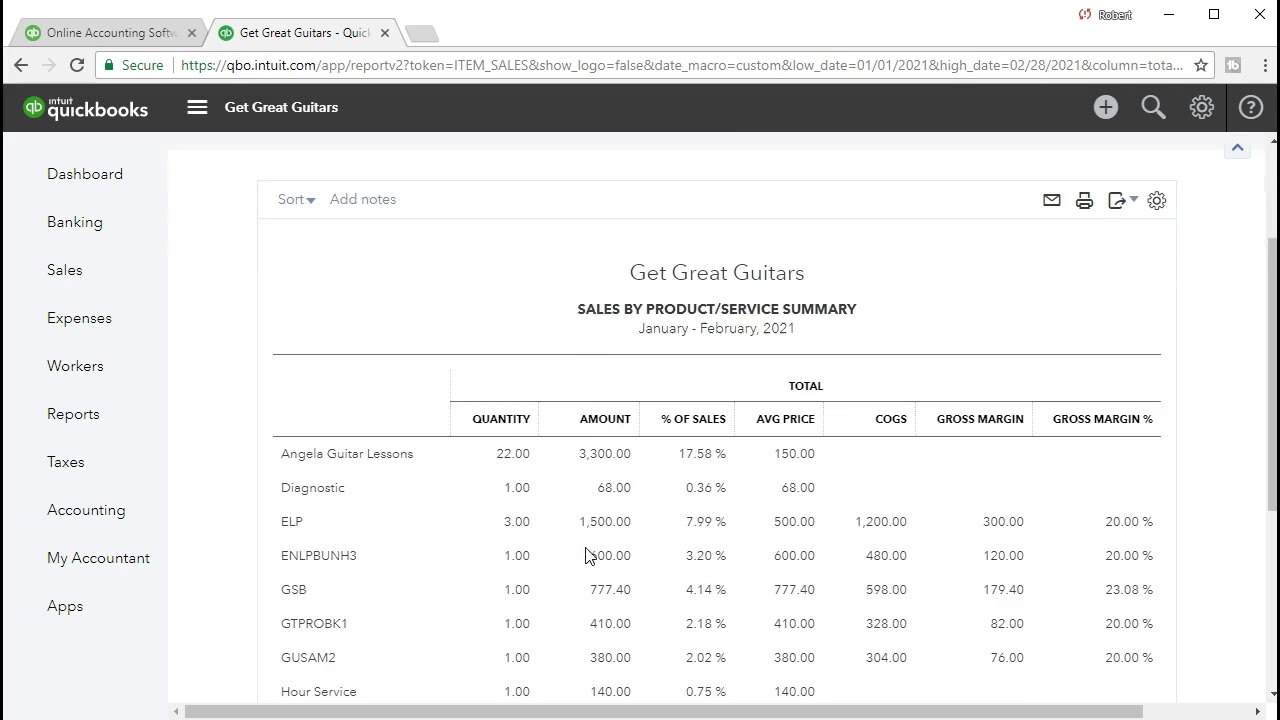

Quickbooks Online 4 25 Sales By Item Summary Report U Youtube

Solved How Do I Get Totals To Show Up On A Check Detail R

How To Save Customized Reports In Quickbooks Online Tutorial Youtube

How To Create A Custom Report In Quickbooks Online Youtube

5 Steps To Using Custom Fields In Quickbooks Online Advanced Firm Of The Future

Quickbooks Help How To Create A Check Register Report In Quickbooks Inside Quick Book Reports Templates Great Cre Quickbooks Help Quickbooks Check Register

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

Onpay Payroll Services Review Payroll Software Payroll Advertising Methods

Why Is My Quickbooks Profit And Loss Report Not Showing Owner S Draw Quickbooks Tutorial

6 Essential Words To Understanding Your Business Finances Small Business Bookkeeping Small Business Finance Business Finance

Unique Start Up Budget Template Xls Xlsformat Xlstemplates Xlstemplate Business Budget Template Business Expense Small Business Expenses