lake county sales tax ohio

Ohio state sales tax. Lake 100 050 725 Wood 100 675 Lawrence 150 725 Wyandot 150 725 Note.

Outside Of Rock Hall 2 20 2016 Rock Hall The Outsiders Ohio

The current total local sales tax rate in Lake County OH is 7250.

. You can find more tax rates and allowances for Lake County and Ohio in the 2022 Ohio Tax Tables. To calculate the sales tax amount for all other values use. The December 2020 total local sales tax rate was also 7250.

2nd Quarter effective April 1 2020 - June 30 2020 Rates listed by county and transit authority. There are a total of 576 local tax jurisdictions across. 7am 6pm EST M-F Live Answering.

6 rows The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax. 1st Quarter effective January 1 2020 - March 31 2020 There were no sales and use tax county rate changes effective January 1 2020. Has impacted many state nexus laws and sales tax collection requirements.

Lake County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Lake County Ohio. 1149 rows Ohio Sales Tax. In addition to taxes car purchases in Ohio may be subject to other fees like registration title and plate fees.

If you need access to a database of all Ohio local sales tax rates visit the sales tax data page. What is the sales tax rate in Lake County Ohio. Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225.

All numbers are rounded in the normal fashion. Automating sales tax compliance can help your business keep compliant with changing. Let the clerk know you are on the APP and would like to put a hold on the payment.

Average Sales Tax With Local. Checks made payable to. Some dealerships may also charge a 199 dollar documentary service fee.

The 2018 United States Supreme Court decision in South Dakota v. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 725 in Lake County Ohio. These records can include Lake County property tax assessments and assessment challenges appraisals and income taxes.

There is no applicable city tax or special tax. Ohio has a 575 sales tax and Lake County collects an additional 15 so the minimum sales tax rate in Lake County is 725 not including any city or special district taxes. 1-866-907-2626 Call Center Hours.

The sales tax rate for Lake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Lake County Ohio Sales Tax Comparison Calculator for 202223. Lake County OH currently has 588 tax liens available as of August 22. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Lake County OH at tax lien auctions or online distressed asset sales.

Summary of Lake County Ohio Tax Foreclosure Laws. Lake County sales tax. Email protected Customer Service.

Call Lake County Treasurers Office at 440350-2519 440918-2519 or 440298-3334 Ext. Ohio collects a 575 state sales tax rate on the purchase of all vehicles. The states sales and use tax rate is currently 575 March 11 2022.

Tax Ease Ohio LLC. Box 645191 Cincinnati OH 45264-5191. A billing representative will assist you.

To review the rules in Ohio visit our state-by-state guide. Lake County in Ohio has a tax rate of 7 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Lake County totaling 125. There are also county taxes that can be as high as 2.

You can print a 725 sales tax table here. 2519 no later than five days prior to the due date. Rates listed by city or village and Zip code.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The Lake County sales tax rate is. The Ohio state sales tax rate is currently.

Certain types of Tax Records are available to the general public. US Bank as CF for Tax Ease Ohio. There were no sales and use tax county rate changes effective July 1 2020.

Please call us at once if you did not receive your bill or if you have any indication that your tax bill may have been misdirected. 10 rows The total sales tax rate in any given location can be broken down into state county city. Sales tax in Lake County Ohio is currently 7.

The 725 sales tax rate in Buckeye Lake consists of 575 Ohio state sales tax and 15 Licking County sales tax. Michael Zuren Lake County Treasurer 105 Main Street Painesville Ohio 44077 Office open 800 am to 430 pm Monday thru Friday Holidays Excluded Phone. For tax rates in other cities see Ohio sales taxes by city and county.

For Weekend Concerts Under Open Skies Festivals Farmers Markets Check Out Lock 3 In Akron Ohio Cultural Destinations Akron Ohio

Cuyahoga River Water Trails Get Involved Cuyahoga Valley National Park Ohio County Falls City

Westlake Ohio Sign Prior To 2011 Westlake Ohio West Lake Ohio

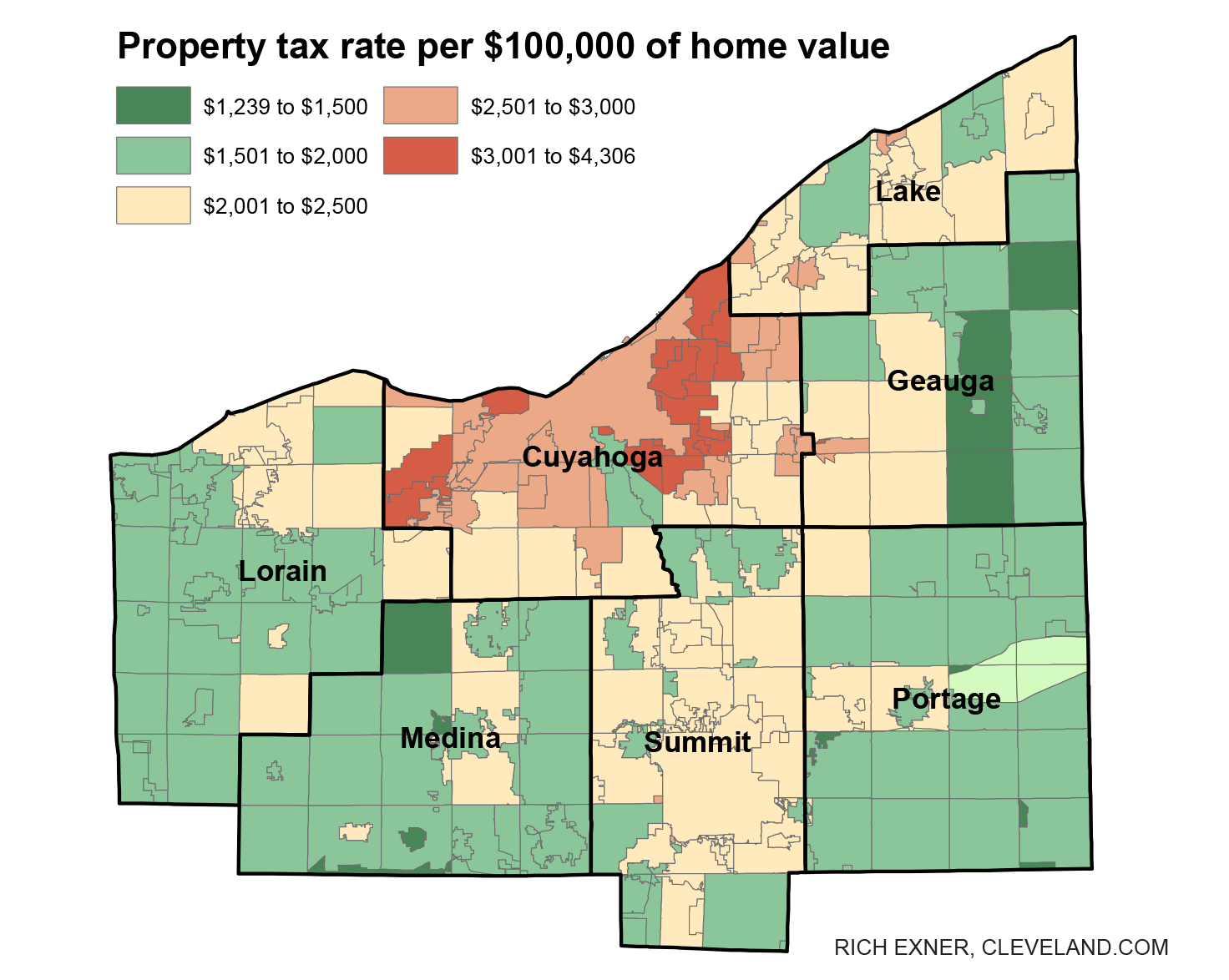

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Ohio Sales Tax Guide For Businesses

Oak Openings Hiking Trail Ohio Travel Camping And Hiking Hiking Trails

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Public Health Advisory For East Fork Lake Lifted Clermont County Ohio Government

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Inland Lakes Ohio Department Of Natural Resources

Ohio Sales Tax Rates By City County 2022

Lake And Reservoir Fishing Maps Ohio Department Of Natural Resources

Natural Lakes In Ohio Ohio Department Of Natural Resources

Lake White State Park Ohio Department Of Natural Resources

Top 13 Things To Do In Conneaut Ohio Updated 2022

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Vintage Ohio License Plate Green White 1974 Free Shipping Etsy License Plate Garage Decor Vintage License Plates